24.2.08

Business Trip

Next week I'll be on business trip to Tokyo, Japan. Therefore, the blog will not be update. When I come back next weekend, I'll update the blog.

20.2.08

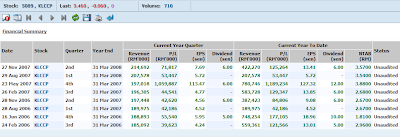

VITROX CORPORATION BERHAD (VITROX)

Its earning posted a new record in this quarter. Revenue also a record.

Current full year earnings grew 1.5 times compare to FY06. Interesting part is that this company has zero borrowings.

Dividend distributed is 0.5sen, making total of 2 sen in current FY.

Its share price is sluggish but showing signs of improvement.

Here is the result.

Current full year earnings grew 1.5 times compare to FY06. Interesting part is that this company has zero borrowings.

Dividend distributed is 0.5sen, making total of 2 sen in current FY.

Its share price is sluggish but showing signs of improvement.

Here is the result.

HUNZA PROPERTIES BERHAD (HUNZPTY)

HUNZPTY recorded almost double the earning compare to 2Q07. It says in its report that Alila and Mutiara Seputeh are the main contributor.

Its cumulative earnings for 2Q current FY has already surpassed its cumulative 3Q preceding year.

No dividend distributed.

Its share price is still sluggish.

Here is the report.

Its cumulative earnings for 2Q current FY has already surpassed its cumulative 3Q preceding year.

No dividend distributed.

Its share price is still sluggish.

Here is the report.

My Stocks Taking Black Candles

Sentiment is very bearish now. Even companies with good earnings beaten.

As you can check, all stocks under my watch are reporting good earnings. Their 3 quarters earnings usually outperform whole year earning of the previous year. Obviously their earnings are improving. It is just waiting for the right timing to jump in.

As you can see, on the right-hand-sidebar, i list up all (Well, only four) potential stocks heading north. Even then, after some climbs they will all turned bearish, technically.

Ramunia - long black candle

Sarawak - bearish runaway Gap

Annjoo - A little bearish, still hoping

Afg - Probably good time to pick some shares. Let see tomorrow's price action.

Of course nobody know how long this condition will continue, only GOD knows. =sigh=.

But, just to keep the spirit high, NEVER GIVE UP!

As you can check, all stocks under my watch are reporting good earnings. Their 3 quarters earnings usually outperform whole year earning of the previous year. Obviously their earnings are improving. It is just waiting for the right timing to jump in.

As you can see, on the right-hand-sidebar, i list up all (Well, only four) potential stocks heading north. Even then, after some climbs they will all turned bearish, technically.

Ramunia - long black candle

Sarawak - bearish runaway Gap

Annjoo - A little bearish, still hoping

Afg - Probably good time to pick some shares. Let see tomorrow's price action.

Of course nobody know how long this condition will continue, only GOD knows. =sigh=.

But, just to keep the spirit high, NEVER GIVE UP!

19.2.08

OIL IS HEADING TOWARDS $100 MARK

Credit Suisse Strips $1B From 1q Profits

Credit Suisse Strips $1B From 1q Profits. (read: Sub-Prime Issue is far from over)

Here is the link.

http://biz.yahoo.com/ap/080219/switzerland_credit_suisse.html

Here is the link.

http://biz.yahoo.com/ap/080219/switzerland_credit_suisse.html

YNH PROPERTY BERHAD (YNHPROP)

ALLIANCE FINANCE GROUP (AFG)

AFG share price reacted positively on the result announced. It is now riding on the momentum started from the recent low of 2.78. It closed at nicely 50% Fibonacci. If the price can penetrate 50%, and 3.10, it could re-visit its recent high of 3.30.

The short term GMMA has penetrated the long term GMMA. This uptrend might be brief due to current negative sentiment worldwide.

Here is the technical outlook.

** I've added AFG into my Technical Analysis column at the sidebar.

The short term GMMA has penetrated the long term GMMA. This uptrend might be brief due to current negative sentiment worldwide.

Here is the technical outlook.

** I've added AFG into my Technical Analysis column at the sidebar.

SOUTHERN STEEL BERHAD (SSTEEL)

SSTEEL 4Q result looked very good. Net profit is at the highest level for this quarter.

Cumulative revenue is at the highest level.

Cumulative net profit more than double compare to last year's.

No dividend rewarded in this quarter. Total dividend for this year is 7.5 sen, a little higher than last FY.

Its share price showed a little recovery today and might continue tomorrow.

Below is the result.

Cumulative revenue is at the highest level.

Cumulative net profit more than double compare to last year's.

No dividend rewarded in this quarter. Total dividend for this year is 7.5 sen, a little higher than last FY.

Its share price showed a little recovery today and might continue tomorrow.

Below is the result.

SUNWAY CITY BERHAD (SUNCITY)

2Q08 result for SUNCITY was up on revaluation of its properties.

NTA is up from RM3.16/share to RM3.51/share.

However, it says that even excluding the revaluation, its profit increased. It's good to hear this.

No dividend announced for this quarter.

Its share price still on downtrend.

Here is the result.

NTA is up from RM3.16/share to RM3.51/share.

However, it says that even excluding the revaluation, its profit increased. It's good to hear this.

No dividend announced for this quarter.

Its share price still on downtrend.

Here is the result.

18.2.08

SocGen is reporting its result this week.

According to Reuters, Scandal-hit French bank Societe Generale and peer BNP Paribas and Barclays, report results this week, the week of 18th February 2008.

The results could trigger another significant drop in indexes across the world. Sentiment is bearish. Therefore, no buying this week or two.

http://www.reuters.com/article/marketsNews/idCAL1849510820080218?rpc=44&sp=true

The results could trigger another significant drop in indexes across the world. Sentiment is bearish. Therefore, no buying this week or two.

http://www.reuters.com/article/marketsNews/idCAL1849510820080218?rpc=44&sp=true

ANN JOO RESOURCES BERHAD (ANNJOO)

ALLIANCE FINANCE GROUP (AFG)

17.2.08

TSH RESOURCES BERHAD (TSH) - Update 4Q 2008 Result

Here is an update on 4Q result for TSH.

Revenue up 40% compare to last FY.

EPS nearly double compare to last year.

Dividend of 6.5 sen distributed compre to 0 in last FY. Good development.

Its share price is still in the primary, long-term up trending, but it looked like it has already started a route to the south, short-term downtrending.

Here is the result.

Revenue up 40% compare to last FY.

EPS nearly double compare to last year.

Dividend of 6.5 sen distributed compre to 0 in last FY. Good development.

Its share price is still in the primary, long-term up trending, but it looked like it has already started a route to the south, short-term downtrending.

Here is the result.

14.2.08

KLCI - TECHNICAL ANALYSIS

The Composite Index is crossing the 50% fibonacci line. It is looking good until yesterday. This index might be driven by the Election element that is going-on right now. As long as the price stays in the uptrend channel you can feel relieve (even if it's in the lower portion of the channel).

This might also be driven by the news two days ago that was saying Malaysia as a safe haven during volatile period. I agree that our corporate result has improved. Take a look at the reports. They say it all.

This might also be driven by the news two days ago that was saying Malaysia as a safe haven during volatile period. I agree that our corporate result has improved. Take a look at the reports. They say it all.

13.2.08

ANNJOO, SARAWAK, RAMUNIA.

Yesterday i posted 3 graphs. I expected those to go up today. But the election announcement spoilt the mood. Only Sarawak held up strongly. Huge volume supported the price. Ramunia and Annjoo got full BLACK candle. For Annjoo, it is still in the uptrend channel, but if the price fell apart, i guess we have to wait for a re-start.

'People' say, based on history, market will rally during election. But today's action made me wonder, "What is happening??" Is there a risk during this upcoming election? Is the opposition going to rule the country this time? During driving back from work today ,I had this little funny feeling that the opposition is going to win quite a big portion. However, I still want the current government to rule the country as they looked like they are going to bring more development to the country. So there you go, i am supporting the current government, obviously.

'People' say, based on history, market will rally during election. But today's action made me wonder, "What is happening??" Is there a risk during this upcoming election? Is the opposition going to rule the country this time? During driving back from work today ,I had this little funny feeling that the opposition is going to win quite a big portion. However, I still want the current government to rule the country as they looked like they are going to bring more development to the country. So there you go, i am supporting the current government, obviously.

10.2.08

YNHPROP - TECHNICAL ANALYSIS

Weekly GMMA looked like it is still holding the uptrend. The price has weaken a little. Let see the daily price below.

The daily price showed that it might have built a new uptrend channel. The GMMA has started to separate between traders group and investors group.

The price recently retreated to just 50% Fibonacci (2.60) and bounced. Since it has taken out recent 2.78 high, the price is now heading towards 2.90. Once the MACD Histogram turned upper half in green, it is confirm that this stock heading higher. Watch out.

SCOMI GROUP BERHAD (SCOMI)

SCOMI's result in the 2Q was due to sale of Scomi Oilfield Limited. The sale proceed has been utilized to reduce borrowings from 1.74x to 1x. Excluding the sale, the profit increased 55% in 2Q, according to its report.

In 3Q, its profit also increased 36%.

No dividend awarded in 3Q but we can expect dividend in 4Q.

Its share price has been on sideways, a little weaken.

Here is the result.

In 3Q, its profit also increased 36%.

No dividend awarded in 3Q but we can expect dividend in 4Q.

Its share price has been on sideways, a little weaken.

Here is the result.

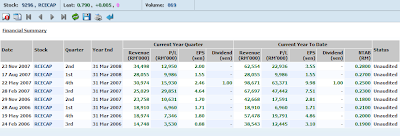

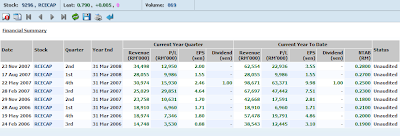

RCE CAPITAL BERHAD (RCECAP)

RCECAP profit is on up trend. Although the relative changes compare to last year is not so significant, it is about to become significant due to higher disposable income in public sector.

Last year, it started to reward its shareholder with a small dividend, 1 sen, insignificant.

Its share price has weaken a little.

Below is the result.

Last year, it started to reward its shareholder with a small dividend, 1 sen, insignificant.

Its share price has weaken a little.

Below is the result.

OSK HOLDINGS BERHAD (OSK)

KLCC PROPERTY HOLDINGS BERHAD (KLCCP)

HUNZA PROPERTIES BERHAD (HUNZPTY)

Its 1Q result was good. Last quarter revenue was the second highest in last 2 years. So does profit.

Dividend for FY 2007 (12.5 sen) also significantly higher than FY2006 (7.5 sen).

Its share price, not so encouraging. Now it's on sideways, probably base-building. It might pick-up in 2H this year.

Here is the result.

Dividend for FY 2007 (12.5 sen) also significantly higher than FY2006 (7.5 sen).

Its share price, not so encouraging. Now it's on sideways, probably base-building. It might pick-up in 2H this year.

Here is the result.

HAIO ENTERPRISE BERHAD (HAIO)

Last quarter's result was the best result in the past 2 years. Revenue at the highest level, profit as well. Compare to last year, this 2Q result almost double.

Dividend is 3 sen higher.

Its share price, the uptrend which started in early-Oct 2006, has just ended last week, end-January 2008. Not bad for almost 1.5 years of up trend.

Below is the result.

Dividend is 3 sen higher.

Its share price, the uptrend which started in early-Oct 2006, has just ended last week, end-January 2008. Not bad for almost 1.5 years of up trend.

Below is the result.

DRB-HICOM BERHAD (DRBHCOM)

This stock 2Q result has already surpassed its 3Q last years' earning. It looks like it's going to outperform last years' result.

Dividend alson improved. It distributed 0.5 sen more than last year's in 2Q. Last year's dividend was distributed in 3Q.

Its share price is on a down trend.

Here is the result.

Dividend alson improved. It distributed 0.5 sen more than last year's in 2Q. Last year's dividend was distributed in 3Q.

Its share price is on a down trend.

Here is the result.

AFFIN HOLDINGS BERHAD (AFFIN)

AFFIN'S financial result has been improving. Its last quarter (3Q FY2007) revenue was the highest in the last 2 years. Profit also double compare to previous FY2006.

Dividend is same as last year's up to 3Q. While we expect AFFIN will distribute the same dividend as last years', there might be a surprise judging from its profit margin trend.

On its share price, it peaked in early-Nov 07. Now it is on a down trend.

Here is the inancial result.

Dividend is same as last year's up to 3Q. While we expect AFFIN will distribute the same dividend as last years', there might be a surprise judging from its profit margin trend.

On its share price, it peaked in early-Nov 07. Now it is on a down trend.

Here is the inancial result.

TAN CHONG MOTOR HOLDINGS BERHAD (TCHONG)

TCHONG has been in the limelight for quite some time already. Accumulated revenue up to 3Q this FY was less than last year. However, one thing to notice is that its profit is on up trend. Compare accumulated profit until 3Q this FY and last years', you can clearly see that it has surpassed last years' whole year earning. That is a clear sign that its profit margin is improved.

Dividend-wise, it might matched last years' dividend. 5 sen. 4Q result is schedule to be announce on 22 February.

Its share price has started its down trend starting from mid-Nov 2007. It tried to recover in January this year, however, the price couldn't sustain.

Here is the result.

Dividend-wise, it might matched last years' dividend. 5 sen. 4Q result is schedule to be announce on 22 February.

Its share price has started its down trend starting from mid-Nov 2007. It tried to recover in January this year, however, the price couldn't sustain.

Here is the result.

5.2.08

VITROX CORPORATION BERHAD (VITROX)

VITROX financial performance has been good. This FY even better. It has already surpassed last year's earning.

Dividend is also rising.

While the semiconductor sector is not so significant in Malaysia, if this company is targeting foreign income, it might produce a pleasant surprise in its earning.

Here is the result.

Dividend is also rising.

While the semiconductor sector is not so significant in Malaysia, if this company is targeting foreign income, it might produce a pleasant surprise in its earning.

Here is the result.

SARAWAK ENERGY BERHAD (SARAWAK)

SARAWAK ENERGY has made its intention very clear to grow electricity generation in Sarawak to 30GWatt from less than 1GWatt currently. Even at present level, its profit has never been better. Moreover if it has generation capacity of 30GWatt.

Judging from the financial result, we can be sure that the result will only get better. For this FY, it has almost surpass last year's result.

While dividend also in on the rise, we can expect better dividend in the final quarter of this year and the coming years.

One BIG question remain is that the taker of the huge generation capacity. CMSB-RIO TINTO is one of them (completed only in 2010), also possibility in supplying to Kalimantan, Indonesia (even any industrial development evidence yet to be seen), Oil Palm clusters in Sabah, others are yet to be proven.

Here is the result.

Judging from the financial result, we can be sure that the result will only get better. For this FY, it has almost surpass last year's result.

While dividend also in on the rise, we can expect better dividend in the final quarter of this year and the coming years.

One BIG question remain is that the taker of the huge generation capacity. CMSB-RIO TINTO is one of them (completed only in 2010), also possibility in supplying to Kalimantan, Indonesia (even any industrial development evidence yet to be seen), Oil Palm clusters in Sabah, others are yet to be proven.

Here is the result.

4.2.08

PLANTATIONS SECTOR - FRESH FRUIT BUNCHES (FFB) ABOVE 50,000 METRIC TONNES

I list down plantation companies which has FFB output close to or more than 50,000 tonnes.

This data is based on The Star newspaper dated 29 January 2008 for FFB Dec 2007 output.

In alphabethical order based on stock name,

1. Asiatic

2. Bstead

3. Hsplant

4. Ijmplnt

5. Ioicorp

6. Klk

7. Kulim

8. Kwantas

9. Sime

10. Tdm

11. Tsh

12. Twsplnt

13. Unico

This data is based on The Star newspaper dated 29 January 2008 for FFB Dec 2007 output.

In alphabethical order based on stock name,

1. Asiatic

2. Bstead

3. Hsplant

4. Ijmplnt

5. Ioicorp

6. Klk

7. Kulim

8. Kwantas

9. Sime

10. Tdm

11. Tsh

12. Twsplnt

13. Unico

RIVERVIEW RUBBER ESTATE BERHAD (RVIEW)

RVIEW, same as other plantation companies, has a wonderful year of FY 2006/07 due to CPO price. Y-O-Y change was more than 20%. And this FY 2007/08 also will be another bumper year. Until 3Q of this FY, its earnings has almost double. And we still have another quarter to go.

Dividend also rewarded in 3Q this FY and it is more than last years'. For the last 2 years, RVIEW will only rewards its shareholder in the 4Q. This is a good development. We hope the dividend in 4Q will also be double.

Here is the result.

Dividend also rewarded in 3Q this FY and it is more than last years'. For the last 2 years, RVIEW will only rewards its shareholder in the 4Q. This is a good development. We hope the dividend in 4Q will also be double.

Here is the result.

TSH RESOURCES BERHAD (TSH)

TSH is among companies that has more than 50,000 tonnes of fresh fruit bunches (FFB). Result for FY 2006/07 has been the best for the last 2 years. While for FY 2007/08, even we still have another quarter to go, TSH has already outperform its last year's full result.

However, one thing to note is that for FY 2006/07, it did not reward its shareholder with dividend (even the profit increased more than 30%).

Here is the result.

However, one thing to note is that for FY 2006/07, it did not reward its shareholder with dividend (even the profit increased more than 30%).

Here is the result.

FREIGHT MANAGEMENT HOLDINGS BERHAD (FREIGHT)

Freight revenue has been on one-way-street, up to the north. Profit for FY 2007 has already achieve all-time high. Dividend is consistant with 4sen/year. Normally dividend is rewarded on 3Q & 4Q, if Freight decided to disburse some dividend on 2Q, we should watch this stock.

This particular stock might be the gem among all other transporters due to its ability to withstand free-fall in BDI.

Here is the result.

This particular stock might be the gem among all other transporters due to its ability to withstand free-fall in BDI.

Here is the result.

3.2.08

YTL POWERINTERNATIONAL BERHAD (YTLPOWR)

According to the last 2 years result, this company reported its best result last year. Its revenue, profit and dividend at the highest level in FY 2007.

The share price is still continuing its long-term bull run started back from March-2002, had a hiccup in 2nd-half of 2006 and resume its uptrending from end-October 2007 up to now. Judging from its share price, it might be a good time to accumulate now as it is at the bottom of the uptrend.

Here is the result.

The share price is still continuing its long-term bull run started back from March-2002, had a hiccup in 2nd-half of 2006 and resume its uptrending from end-October 2007 up to now. Judging from its share price, it might be a good time to accumulate now as it is at the bottom of the uptrend.

Here is the result.

TA ENTERPRISE BERHAD (TA)

This Finance company is a little bit different from other 'finance' classified companies in Bursa Malaysia. This company has its property division as 'insurance' against slow down in financial services market in Malaysia. It is also in expansion mode trying to penetrate Vietnam financial services market.

Its property division is doing well.

The result shown below is the proof that its property division is contributing quite significantly in its coffer. Up to 3Q accumulated profit already surpassed last year's whole year profit. Accumulated revenue also at the highest level. The fourth quarter result to be announce in March.

Its share price topped in Feb-2007 and has been in downtrend. Let's watch when this counter will reverse.

Its property division is doing well.

The result shown below is the proof that its property division is contributing quite significantly in its coffer. Up to 3Q accumulated profit already surpassed last year's whole year profit. Accumulated revenue also at the highest level. The fourth quarter result to be announce in March.

Its share price topped in Feb-2007 and has been in downtrend. Let's watch when this counter will reverse.

ANN JOO RESOURCES BERHAD (ANNJOO)

Yet another steel company made the cut of 'financial improvement' label on my blog. This is the fourth company who made it.

Following the trend of other steel companies, this company's accumulated 3Q result has already surpassed the whole last year result.

Its accumulated dividend matched last year's up to the 3Q. Let hope it could announce FAT dividend in the final quarter.

Its share price has started the second wave of run-up starting from the first day this year (2nd January 2008). Now we are just waiting for the price to breakout. Probably tomorrow, 4th February 2008.

Below is the financial result.

Following the trend of other steel companies, this company's accumulated 3Q result has already surpassed the whole last year result.

Its accumulated dividend matched last year's up to the 3Q. Let hope it could announce FAT dividend in the final quarter.

Its share price has started the second wave of run-up starting from the first day this year (2nd January 2008). Now we are just waiting for the price to breakout. Probably tomorrow, 4th February 2008.

Below is the financial result.

MALAYSIA STEEL WORKS (KL) BERHAD (MASTEEL)

This is another steel company, after SSTEEL and KINSTEL, that had improved a lot. As you can see from the result, its accumulated result up to 3Q this FY has already surpassed the whole last financial year. It is interesting to see the coming announcement schedule this month end.

Its dividend also has improved a bit compare to last year.

Its share price also still maintain its mid-term uptrend which started from end-Oct 2006. It reached highest level just recently on 11th January 2008. Let see whether it can withstand the external turbulance which coming from the US market (that drag the whole world down together with them).

Here is the result.

Its dividend also has improved a bit compare to last year.

Its share price also still maintain its mid-term uptrend which started from end-Oct 2006. It reached highest level just recently on 11th January 2008. Let see whether it can withstand the external turbulance which coming from the US market (that drag the whole world down together with them).

Here is the result.

YNH PROPERTY BERHAD (YNHPROP)

This is another property company that is currently making its mark in KL. Its results in every quarter of current FY have been outperforming the results in last quarters. Even the revenue in current FY drop a little, it has been able to up its profit. This means its margin has improved. I'm expecting the company to announce another 10sen dividend this month, judging from last year's pattern.

In terms of its share price, we might have missed the high growth of capital gain which started from end-Oct 2006 and ended in May-2007. Lets wait for the next round of share capital gain era probably end of this year.

Here is the financial result.

In terms of its share price, we might have missed the high growth of capital gain which started from end-Oct 2006 and ended in May-2007. Lets wait for the next round of share capital gain era probably end of this year.

Here is the financial result.

SUNWAY CITY BERHAD (SUNCITY)

Sunway City Berhad has created a buzz recently about possibility of setting up The Biggest REIT in Malaysia (or in neighbouring country). Its 1Q result announced in Nov-07 showed quite significant improvement compare to last 1Q FY quarter. 2Q result to be announced on end of this month should be interesting to watch.

In terms of its share price, it might be on a med-term downtrending now. It has had a good uptrend starting from end-Nov 2006 up to the highest level on early-Oct 2007. I'll keep watching its share price development.

In terms of its share price, it might be on a med-term downtrending now. It has had a good uptrend starting from end-Nov 2006 up to the highest level on early-Oct 2007. I'll keep watching its share price development.

SOUTHERN STEEL BERHAD (SSTEEL)

Another steel company that showed vast improvement in current quarter is Southern Steel. Its accumulated profit up to 3Q current FY alone has surpassed whole last FY profit.

It has also started to give generous dividend for every quarter this FY.

Its share price has started its uptrending since 21st December 2007. Good counter to buy and hold.

Here is the result.

It has also started to give generous dividend for every quarter this FY.

Its share price has started its uptrending since 21st December 2007. Good counter to buy and hold.

Here is the result.

KINSTEEL BERHAD (KINSTEL)

Kinsteel's revenue improved very much after it aquires Perwaja Steel last year. Starting from that moment, its revenue surpassed RM 1 billion mark. Now, Kinsteel is planning to list its unit, Perwaja Steel. Things can only get better for this company. With Malaysia's construction sector picking up, the future looks bright.

Here is the financial result.

Here is the financial result.

FABER GROUP BERHAD (FABER)

Current FY 3Q result almost equal its whole last year's result. This is a good development for Faber. Its mission to make Malaysia as health tourism destination is very much welcome. I hope a lot more analysts will take note on this stock. Health tourism has huge potential. However, in terms of its share price, this stock has been moving sideways since end/April 2007.

Here is the financial result.

Here is the financial result.

MALAYSIA AIRPORT HOLDINGS BERHAD (AIRPORT)

AIRASIA BERHAD (AIRASIA)

AIRASIA's financial performance has been good. However, this development has been capped by the high oil price and bad publicity on their fuel hedging strategy recently.Nevertheless, its share price looked like it has started to rebound. I'll keep on watching its price action in the next 2 weeks.

Here is the financial result.

Here is the financial result.

Alliance Financial Group (AFG)

Subscribe to:

Posts (Atom)